- MoneyMoves

- Posts

- Q2 2025 – Market and Portfolio Update

Q2 2025 – Market and Portfolio Update

How did your investments perform in Q2?

What a wild three months it’s been. The dominant headlines? Trump vs Elon, the threat of World War 3, and the rapid rise of artificial intelligence - all playing out in real time on our social media feeds. What a time to be alive.

Unsurprisingly, the markets have reacted just as you’d expect in the face of uncertainty: volatile, choppy, and unpredictable.

But through it all, our approach stays the same. We zoom out and stay the course. Because when it comes to building wealth, time in the market always beats timing the market.

Sentient Wealth: Investor Portfolio Updates

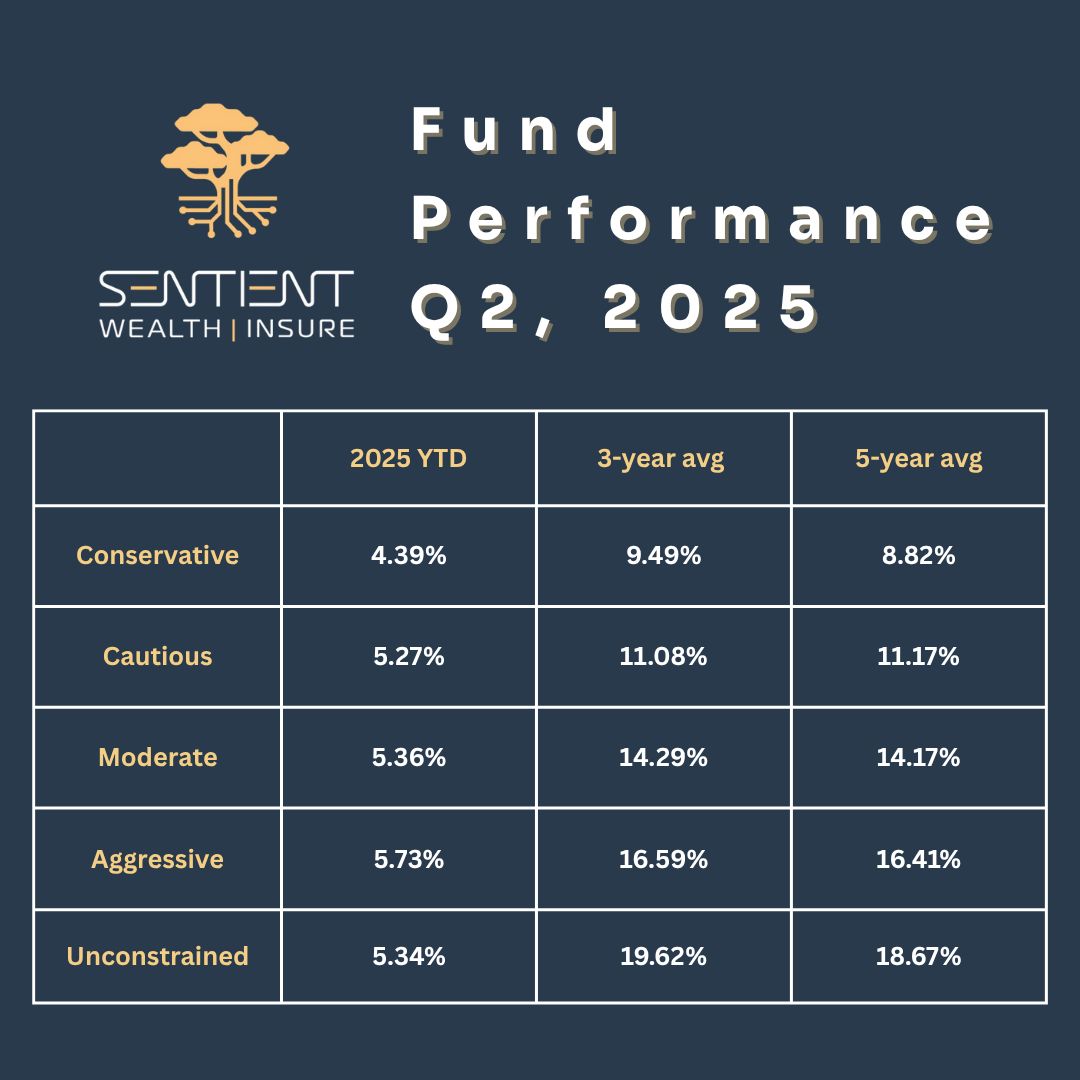

Below are your portfolio updates for the year so far. If you are a client of mine, you are invested in one of these funds on Allan Gray. Asset Allocation for reference:

Conservative: 0% Equity, 100% Cash & Bonds

Cautious: 25% Equity, 75% Cash & Bonds

Moderate: 50% Equity, 50% Cash & Bonds

Aggressive: 75% Equity, 25% Cash & Bonds

Unconstrained: 100% Equity, 0% Cash & Bonds

Returns as at 1 June 2025

Paul’s Personal (High-Risk) Portfolio

We’re back in the game!

After a shaky first quarter with negative returns, Q2 has delivered a solid rebound. Top picks for the quarter include Blue Label Telecoms, Northam Platinum, and Arbitrage (even with the current slim margins).

Bitcoin is still my largest position by far, while the altcoin bundle continues to lag. That said, I’m expecting Bitcoin dominance to ease over the next few months, with liquidity gradually shifting into the altcoin space. Let’s see how it plays out.

If you’d like a second opinion on your portfolio or want to explore any of these themes in more detail, feel free to reach out for a consultation.

Prices as at 30 June, 2025. Disclaimer: This is not financial advice.

Medical Aid and Gap Cover

Exciting news - We’ve expanded our offering! We now have an in-house expert, Jessica, who specialises in medical aid and gap cover.

Jessica is here to help you make sense of your current plan - whether that means confirming it’s the right one or showing you smarter options in the market.

Bringing Jessica on board is part of my approach to making sure all your bases are covered - from investments to insurance, and now health. And no, she’s not AI, she’s the real deal!

Let me know if you’d like to have a quick chat with her!

Thank you for trusting us with your wealth. If you have any questions, want to review your portfolio, or just want to chat about what’s happening in the markets, feel free to reach out anytime.

Warm regards,

Paul & Ingrid

Sentient Wealth

Reply