- MoneyMoves

- Posts

- Q4 2025 – Market and Portfolio Update

Q4 2025 – Market and Portfolio Update

What a year!

What to Expect in This Update

In this newsletter, we share two types of portfolio updates:

Sentient Wealth Investor Portfolios

These reflect the core portfolios we manage for clients via Allan Gray. They show how each mandate (from Conservative to Unconstrained) is positioned and how it has performed.Paul’s Personal (High-Risk) Portfolio

This is my own personal portfolio, run independently and with a high risk appetite. This is for the cowboys out there - NOT for your grandma’s portfolio.

For us, transparency is non-negotiable. We believe it’s important to share progress, performance, and context - not just when markets are strong, but at all times.

Ready? Let’s dive in!

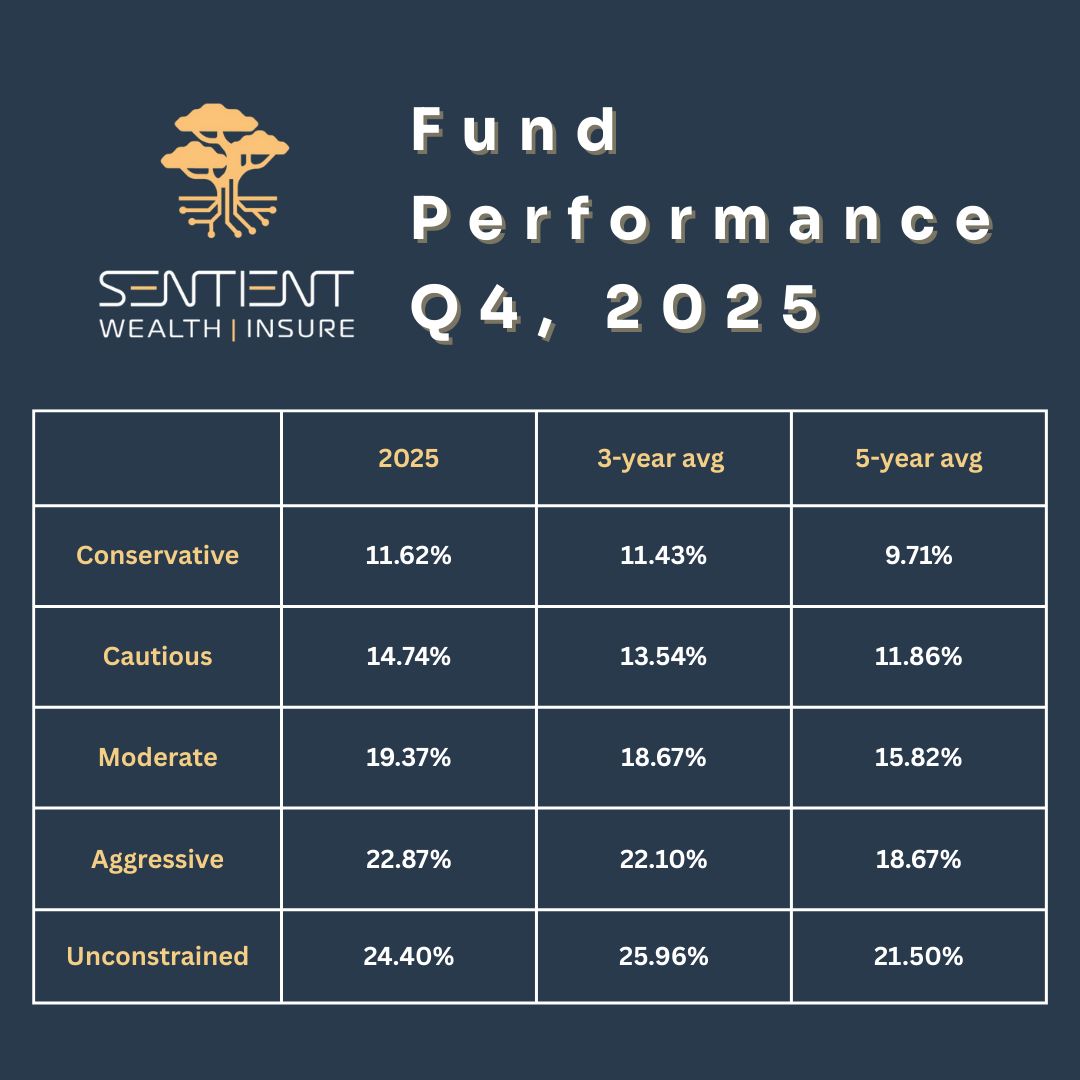

1. Sentient Wealth: Investor Portfolio Updates

Below are your portfolio updates for the year so far. If you are a client of Sentient Wealth, you are invested in one of these funds on Allan Gray. For context, here’s how each portfolio is allocated:

Conservative: 0% Equity, 100% Cash & Bonds

Cautious: 25% Equity, 75% Cash & Bonds

Moderate: 50% Equity, 50% Cash & Bonds

Aggressive: 75% Equity, 25% Cash & Bonds

Unconstrained: 100% Equity, 0% Cash & Bonds

Feel free to check out our latest fund fact sheets under “our portfolios” via this link.

PS: All clients will receive their personal quarterly statements later today, so keep an eye on the mailbox.

Returns as at 31 Dec, 2025

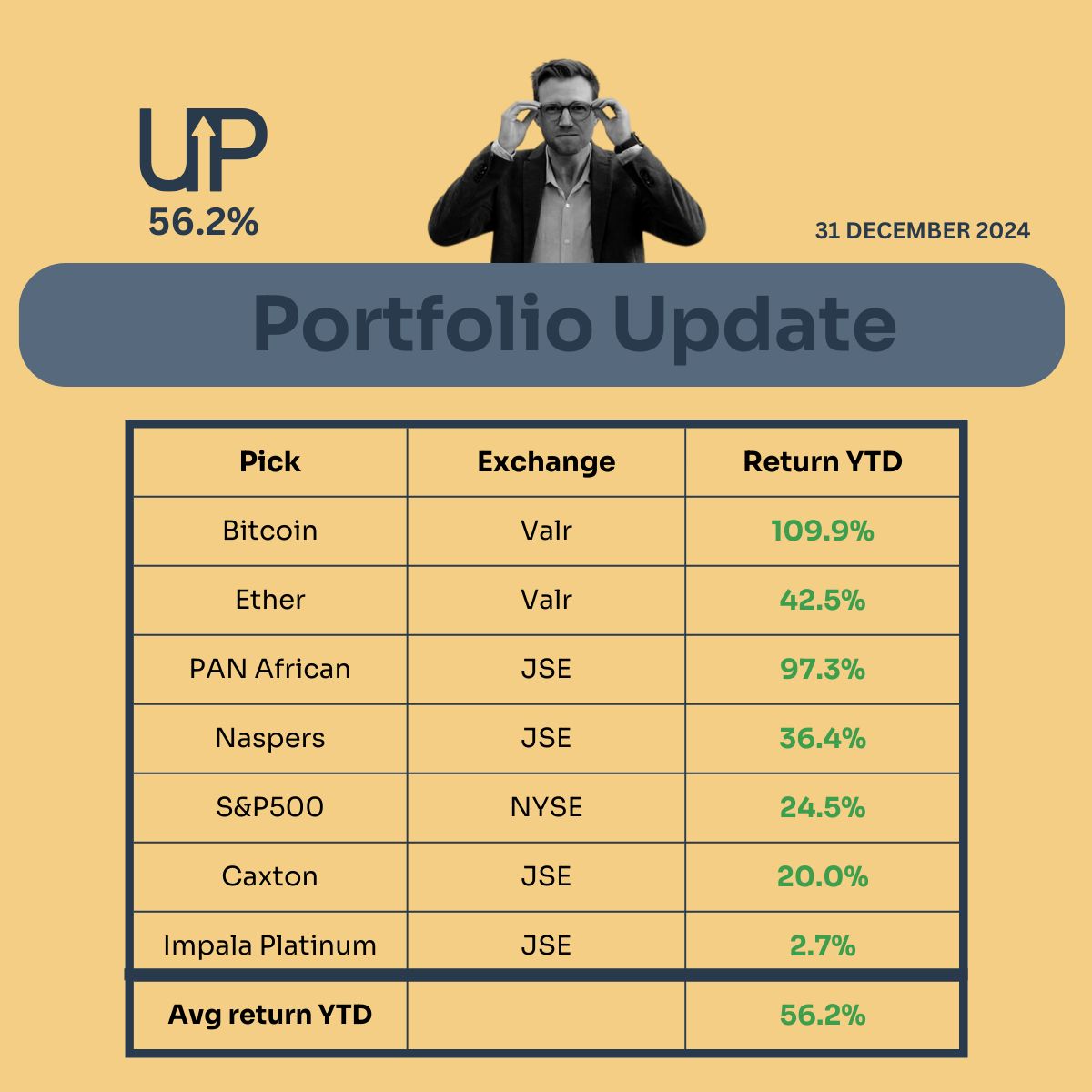

2. Paul’s Personal (High-Risk) Portfolio

Another strong year for the personal high-risk portfolio.

While the crypto allocation didn’t fully deliver in 2025 - largely due to markets peaking around October - we still enjoyed a powerful run-up leading into the highs.

Equities, however, more than made up for it. Commodity exposure in particular stood out, with positions such as Pan African Resources (gold) and Northam Platinum delivering exceptional performance, each growing by more than 200% over the year.

We’ve now been running this portfolio for two consecutive years, with brilliant outcomes each year.

2024: +56.2%

2025: +44.2%

See breakdown below of both years’ picks. Portfolio picks for 2026 will be revealed soon - keep an eye on LinkedIn and Instagram.

Prices as at 31 Dec, 2025. Disclaimer: This is not financial advice.

Prices as at 31 Dec, 2024. Disclaimer: This is not financial advice.

For all clients: we’ll be scheduling our annual review meetings in January. I’ll reach out to you individually to confirm a time that suits you.

In these sessions, we’ll reflect on 2025, lock in our strategy for 2026, and set clear goals for the years ahead.

Thank you for trusting us with your wealth. If you have any questions, want to review your portfolio, or just want to chat about what’s happening in the markets, feel free to reach out anytime.

We Move,

Paul & Ingrid

Reply